Origin: A leading private-sector Indian bank | SME Lending | Customer Onboarding Workflow

Context

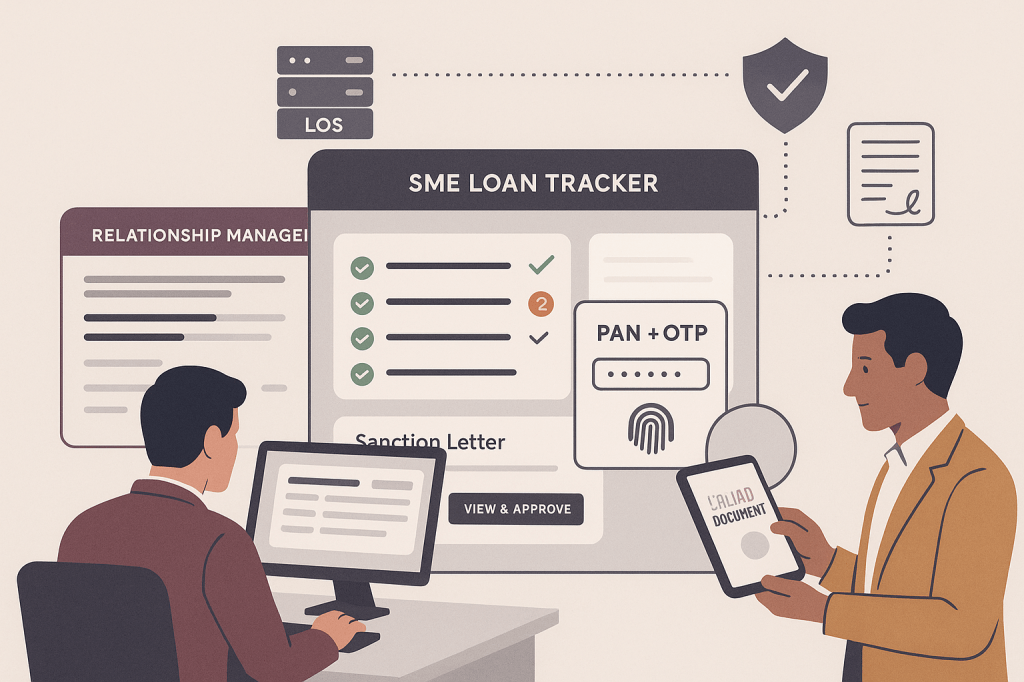

Bank’s SME lending ecosystem saw a recurring gap—many loan applicants were not yet digitally onboarded and lacked access to the primary internet banking app. This pre-onboarded segment was significant, often first-time borrowers, digitally limited, and highly reliant on Relationship Managers (RMs) for progress tracking and document exchange.

Manual workflows created friction across the lifecycle:

- Document collection was dependent on email, phone calls, or branch visits

- Sanction term acceptance was delayed due to physical or PDF-based processes

- Customers had no visibility into their loan application journey

This affected turnaround time (TAT), RM bandwidth, and customer experience.

Problem / Opportunity

We needed a secure and flexible system that could:

- Authenticate pre-onboarded SME customers without app access

- Allow structured document upload and corrections via RM-configured checklists

- Digitally deliver sanction letters with version tracking and e-signature support

- Enable real-time loan status tracking across stages

- Integrate seamlessly with existing LOS, while supporting multi-round RM-customer interaction

- Maintain compliance with Bank’s internal audit, IT, and regulatory policies

This would not just improve operational flow, but also act as a digital “front door” for first-time SME borrowers.

How We Envisioned the Solution

As product lead, I was responsible for defining and delivering a digital layer that simplified a complex, compliance-heavy lending workflow without compromising control. This meant translating offline behaviors (repeated checklist changes, document back-and-forth, partial uploads) into usable, rule-bound platform logic.

This involved:

- Designing a scalable, event-driven workflow tied to LOS

- Coordinating across product, tech, InfoSec, and SME credit teams

- Building with audit-readiness and fallback flows from day one

- Driving rollout training for RMs across multiple zones

Approach & Decisions

We addressed five key platform questions, with added depth below:

a. How should customers securely access the portal?

We opted for lightweight, credential-less login via PAN + OTP:

- PAN validation checked against LOS records

- OTP triggered to mobile registered during RM-created loan application

- Session-based login with inactivity timeout and lockout retries

Fallbacks included:

- Error messaging for PAN mismatches

- Expired or incorrect OTP logic with resend cooldowns

- RM-assisted recovery flows when mobile numbers needed correction

This ensured ease for SMEs while maintaining platform-grade security.

b. How should documents be requested and submitted?

A dynamic checklist engine handled this:

- LOS triggered checklist generation post pre-screening

- RM could edit, reorder, or append checklist items before link sharing

- Customers uploaded documents against each checklist item with contextual tooltips

- Supported multiple file types, with validations on format, size, and date

- Each checklist version was timestamped and versioned

Documents were auto-synced into LOS, visible live to RMs.

Edge cases handled:

- Duplicate uploads flagged with alerts

- Mandatory fields enforced before submission

- Comments attached by RM on rejected uploads

c. How were sanction terms managed and signed?

Upon internal approval, the LOS triggered sanction letter generation:

- Document was converted to a secure PDF with watermark and tracking ID

- Delivered via the portal with preview + approve workflow

- Approval required OTP to reconfirm customer identity

- RM got real-time notification once terms were accepted

Version control ensured that if terms changed (e.g., due to revaluation or condition changes), older versions were archived and marked invalid.

d. How configurable should the flow be for RMs?

We offered a policy-governed but flexible interface:

- RMs could define document types, custom names, and comments

- Checklist templates were pre-configured by product teams and auto-loaded based on loan type

- RMs could assign optional vs. mandatory tags

- System allowed on-the-fly checklist edits, even mid-process

- Alerts sent to customer whenever the checklist changed

This allowed flexibility without compromising standardization.

e. How did we give visibility to stakeholders?

We designed role-specific dashboards:

- Customers saw current stage with next-step action prompts (e.g., “2 Docs Pending Upload”)

- RMs viewed portal activity (last login, doc status, sanction acceptance) within LOS

- Operations teams had an internal log viewer for audit and support resolution

- Logs were export-ready and stored in line with RBI audit requirements

All major user actions were event-logged with timestamps and IP metadata.

Platform Outcomes and Product Impact

- 30% reduction in loan document-related turnaround time

- <5% support dependency, with customers able to self-track application stage

- 100% checklist version traceability, meeting internal audit needs

- Significant RM productivity boost, freeing time from manual follow-ups

- Supported onboarding of 200+ SME customers in first 6 months without Bank’s main app access

Risks & Challenges Addressed

- Partial Digital Literacy: PAN + OTP login ensured inclusion without complexity

- Checklist Volatility: Versioning + alerts preserved clarity during multiple changes

- Abandonment Risk: RM portal had nudges/alerts for follow-ups

- Audit Requirements: All flows had event logs with export capabilities, reviewed with Risk & InfoSec teams

- Sanction Fraud Risk: OTP-gated term approval ensured signature legitimacy

Product Learnings with Broad Applicability

This project reinforced scalable design patterns applicable across fintech, lending, and customer onboarding domains:

Transitional digital layers matter

You don’t always need full app onboarding—intermediate portals can deliver a huge impact with less friction.

Checklist configurability + versioning is a powerful pattern

Specially in regulated domains where document needs evolve during the journey.

Role-specific UX boosts productivity

Dashboards tuned to RM vs customer needs reduce training, error, and hand-holding.

Audit isn’t an afterthought

Build in traceable, export-ready logs from day one—especially when handling financial workflows. Simplicity on the surface, complexity underneath

Great platforms let users do simple things easily, while managing all edge cases behind the scenes.

Conclusion

This initiative served as a strategic leap in Bank’s SME lending evolution—transforming manual, RM-heavy workflows into a seamless, compliant, and user-friendly digital layer. By building for pre-onboarded customers and focusing on configurability, traceability, and audit-readiness from the ground up, we created a solution that aligned deeply with both operational efficiency and customer empowerment.

Key success factors—like version-controlled document flows, OTP-based secure access, and RM-configurable checklists—offered reusable design patterns for future digital initiatives across lending and onboarding. In a domain often dominated by legacy processes, this portal set a new standard: platform simplicity on the surface, regulatory robustness underneath

Leave a comment